Are you searching for a solution that your GST Offline Tool provided by the GST portal owned by GSTN is not working?

Are you searching for a

solution that your GST Offline Tool provided by the GST portal owned by GSTN is

not working?

Here some simple step to resolve the issue.

First download the utility from the following

address

Then unzip the

folder by any unzipping softwares like Winzip, Winrar etc.

Extract the

folder . This folder contain following items

1.

Gst Offline Tool - exe file

2.

GSTR-1 Excel Workbook Template

3.

Invoice upload Offline Tool user Manual -Pdf Help file

4.

Read Me Text file

5.

Section wise CSV File

System Requirement

To use the tool efficiently, ensure that you have the

following installed on your system:

1. Operating system Windows 7

& above

2. Browser: You need one of these browsers

installed on your system.

o

Internet Explorer 10+

o

Google Chrome 49+

o

Firefox 45+

o

Safari 6+

3. Microsoft Excel 2007 & above

4. Alternatively , for any below version

the tool will open in a default browser.

5. Download latest Java version from

and restart your PC

Note:

- This tool does not work on Linux

and Mac operating system

- Currently this tool is released

for GSTR-1 form

How do I know if downloaded gst_offline_tool.zip file is

not corrupt?

Match one of

the values provided in your downloaded file with the ones mentioned below.

If there is an exact match, then your file is not corrupted. Else, download

again.

Where do I find the values?

Windows : (Run

from windows power shell)

Get-FileHash

<<FileUrl>> Algorithm <<SHA256>>

Eg:

Get-FileHash C:\Users\Test\Downloads\gst_offline_tool.zip -Algorithm SHA256

Your unique values:

SHA256:9A169DACDDC4F92ED7B80A266D8F4A07E497DCE15F876A6CD2B5C3BB07C4C4BE

Installation.

Install the Offline Tool in your Windows PC , preferably Windows - 7 or Up with MS office installed. For that double click the GST

Offline Tool exe file and wait for complete installation.

This software is used for creating a Java based text file

- JSON File- which can be uploaded to the

GST Portal. The data for creating the JSON file is retrieved from the excel

file, CSV files etc. However the Excel format or CSV format should be as per

the sample files provided by GSTN through the offline utility bundle folder.

Some softwares like GSP ( GST Suvidha Provider) softwares need not require

this software for creating JSON file. Such GSP softwares can directly make

JSON file form the data entered in the software.

Excel Template

This Excel

Template containing different sheets for various supply details of the business

firm. The purpose of each sheet is explained in the first page of Excel sheet

and also in Pdf Help file in the folder. Some sample data are also entered in

the Excel file for reference. Before entering your data please create a

copy of the excel sheet with a suitable name of your choice. For eg. Sales in

July etc. Then delete the sample data and enter your own data for the

corresponding month. Save

Why these CSV files?

CSV files provided with this software are samples only.

Data can be uploaded using the CSV files . Some existing accounting

softwares are capable of creating CSV files from the data already entered.

If Tax payer converts the data from the softwares as per the format / sample

CSV files provided by GSTN , there is no need to re-enter the data in the above

Excel template. But if no such softwares are being used by the

taxpayer, the TP can use Excel Template.

How can use the software ?

After installation , there will be a icon on of your Desktop

with name"GST Offline Tool'. Just double

click on it. It will open the software.

When

I click on the icon some window opens and immediately closes. What is the

solution ?

First of all please ensure that the Java version is

updated one. If it is updated , then do the important following step.

Open your browser , preferably CHROME browser-

and enter following address in the address bar and hit Enter key

It will

definitely work.

How can create JSON file ?

Open the software in your browser, the click NEW.

Then in the screen enter your GSTIN, Tax year, month

etc. the Proceed

Select the Excel template or CSV file - section wise if

you are using CSV format.

Proceed. It will give warning and continue the process.

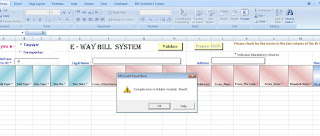

After successful completion all the data will be

integrated to the Offline Tool

Click 'Summary' button to view or edit (if require) the

data in the tool.

If every thing right . Click ' GENERATE' button . It will

create the JSON file and will be downloaded to your PC. This JSON file

can be uploaded to the return.

How much time we can upload the data?

You can upload

the data as much intervals as your requirements, like daily, weekly, biweekly

and monthly etc. Only 19000 data

can be uploaded at a time. So you can use multiple times for uploading. Don't forget delete the data in your software

before creating a new JSON file. For that just click DELETE ALL INVOICES button of the software.

The reciepient

Tax payer can view your data immediately after the uploading of your data.

Enjoy Uploading

Shijoy James

Commercial Tax

Inspector

Kozhikode, Kerala

Comments

Post a Comment